10 Key Takeaways From the Proposed City of Durham Budget

The FY2026 City Budget goes to a City Council vote on Monday, June 16

Happy June!

The weather is getting beautiful here in the Bull City and that means the adoption of the new fiscal year budget is right around the corner. There is a lot that goes into the budget and budget-making process, and I hope to provide some takeaways for you below. You'll find a "short version" explanation and a "long version." But if neither of those explanations provide enough for you, I encourage you to go straight to the City's Budget Development process webpage to find information on the current proposed budget and past budgets.

Short Version

Durham's City Manager, Bo Ferguson, presented the fiscal year 2025-26 budget and capital improvement plan (CIP) during the May 19th City Council meeting. The final public hearing on the proposed budget was June 2nd. The budget will receive a Council vote on Monday, June 16th.

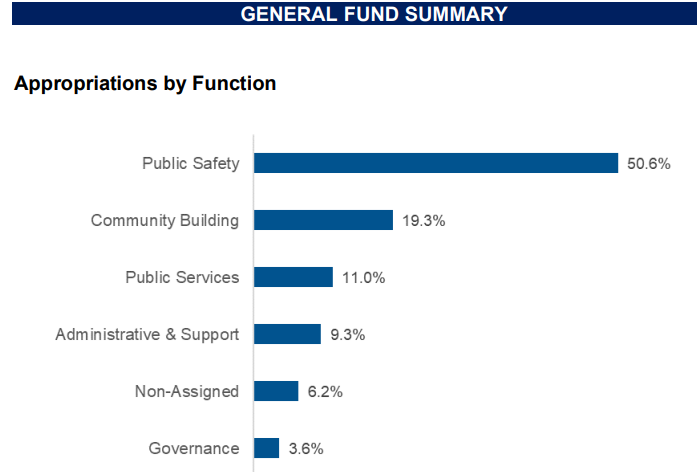

The proposed budget coincides with Durham County's property revaluations, which appraised real property values 71.6% higher than in 2019, when the revaluations were last conducted. The city's proposed property tax rate is 43.71 cents (per $100 assessed value), a decrease of 15.91 cents over the FY2024-25 rate of 59.62 cents and 5.48 cents above the revenue-neutral rate of 38.23 cents. The general fund is one of several city funds and below is a breakdown of the appropriations by function. Public Safety continues to be the largest general fund expenditure, which includes the Community Safety, Emergency Communications, Emergency Management, Fire, and Police Departments.

Long Version

The context of this year's budget:

The context of municipal budgets is not something residents are unfamiliar with. But its good to remember the guardrails and broader patterns within which we’re operation.

Auto-centric sprawl generates inadequate public revenues while service and infrastructure maintenance costs balloon -- all in exchange for carbon-intensive, exclusionary, and privatized development patterns.

County Revaluation If you are a homeowner, you likely received a letter from Durham County earlier this year with a new property tax valuation. This year, new appraisals resulted in an average 71.6% increase in property values since 2019 -- a big change compared to past revaluations.

Neoliberalism and Austerity Politics Over the last half century, as New Deal programs have become dismantled and neoliberalism grew to become the main guiding philosophy behind federal policymaking, municipalities have experienced defunding and chronic underfunding; In 1980, federal dollars accounted for 22 percent of municipal budgets and by the end of Reagan’s second term, federal aid was only 6 percent with continued slashing of revenue up to today. Currently, rightwing-driven federal program cuts, gutting of key science and education programs, attacks against higher education, and threats to social and economic programs are contributing to macroeconomic instabilities. Meanwhile, the North Carolina legislature has not only sought to underfund and privatize public education, it has continued to pass law after law removing municipalities' autonomy and tools for good governance in a process called preemption.

Suburban Sprawl Over less than a decade, Durham City Council has approved tens of thousands of acres of fiscally and environmentally unsustainable sprawl (see a single night of Planning Commission cases from 2022 here). As has been widely researched and documented by planning academics and practitioners alike, auto-centric sprawl generates inadequate public revenues while service and infrastructure maintenance costs balloon -- all in exchange for carbon-intensive, exclusionary, and privatized development patterns. It also increases reliance on cars, drastically undermining Durham’s Vision Zero goals and further offsetting millions of public dollars committed toward safer streets. Strong Towns calls sprawl the "Growth Ponzi Scheme" for its detrimental impacts on local budgets. While large corporate developers extract big profits from land development and homogenous homebuilding, externalities are passed along locally and wealth is redistributed from Durham's working class to the Wall Street investors behind the big homebuilding companies.

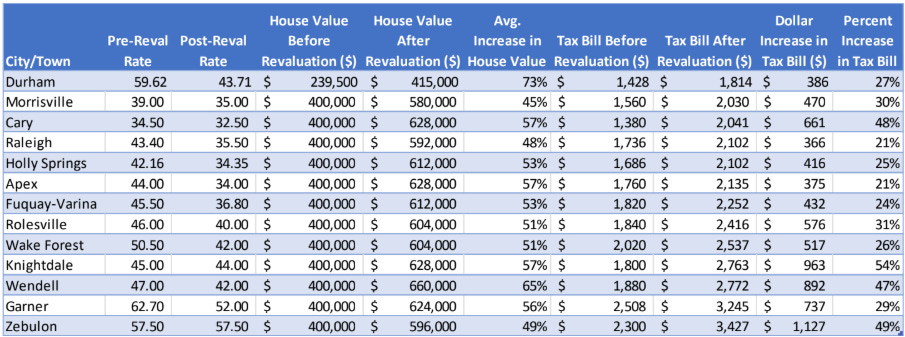

Durham in the Region Durham has historically been poorer than municipalities in Orange and Wake Counties, meaning that for decades even higher tax rates generate less per capita revenue. It's tempting to compare Durham against our regional neighbors - and worthwhile sometimes too - but despite huge growth in rents and property values, Durham continues to have lower incomes and lower property values than our municipal neighbors. The chart below compares pre- and post-revaluation property tax rates and tax bills.

Takeaway #1: Most of our property tax payments are going to be higher this year. The chances of a higher or lower bill depends largely on the change in each individual property revaluation as it relates to the average rate of change of 71.6%. This is not something that I take lightly and it is not something over which I have full control. More and more people are struggling to pay for housing, transportation, childcare, education, and everything else. Much of this can be attributed to the context that we find ourselves in. But in the short term we at the City do have a choice to cut spending, reduce worker pay raises, eliminate some programs, and/or forego critical capital investments. I remain frustrated with some of the choices that past and present Councils have made that impact our long-term public finances, but there are few places the city could afford to cut from the current budget proposal without hitting needed programs and investments. To help defray the costs that could hit some homeowners in the revaluation shakeup, I have been pushing for expansion of the Low Income Homeowners Relief Program, administered by the county and paid into by the city. Are you eligible or do you know someone who is eligible for the grant? Have you or do you know someone who has applied for the grant? Do you feel that you need the grant to make ends meet but are not eligible under the current requirements? If so, I would like to hear from you about your experience. Please reach out at Nate.Baker@DurhamNC.gov.

Takeaway #2: Durham is making several major long-term capital investments. By far the largest investment is in a new Jordan Lake Water Treatment Plant paid for primarily through water utility rates. The City Public Works operation center, emergency operations center, South Ellerbe Stormwater restoration project, Durham Rail Trail, and new Fire and EMS station, are moving ahead, along with other critical capital investments. The annual pavement management program is the largest CIP expenditure.

Takeaway #3: Durham is keeping buses fare-free while expanding service. Keeping buses fare free is a critical top priority and one that I will continue fighting for. Fare-free transit eliminates the wasteful expenses of fare collection, makes transit more efficient by eliminating wait times as riders pay their fares onboard, reduces conflicts between drivers and riders, offers a universal public service, takes cars off the road, and helps low wealth families who make up the largest portion of GoDurham riders. With the chronic underinvestment and depletion of federal resources for transit, GoTriangle and GoRaleigh have reinstated fares showing the challenge in maintaining this service. In addition to remaining fare-free in the coming fiscal year, GoDurham will be adding lines, hiring three new bus rapid transit (BRT) planners, and revitalizing the Durham Station.

Takeaway #4: Expect greater action on homelessness services. Tragically, the United States is setting record after record of growing numbers of unhoused people, with the fastest growing segment of unhoused people being children. To be clear, this is a policy choice and a national disgrace. Durham is not immune to this trend. With many moving parts in the homelessness services arena, a Homelessness Services Strategic Plan was one of my top priorities and the City will be moving forward with a plan and action over the coming year. While we do not have enough resources to end homelessness at the local level, the city has the opportunity to lead a multijurisdictional effort and coordinate limited resources to improve our city's services to the most vulnerable populations. Stay tuned as we begin this important project.

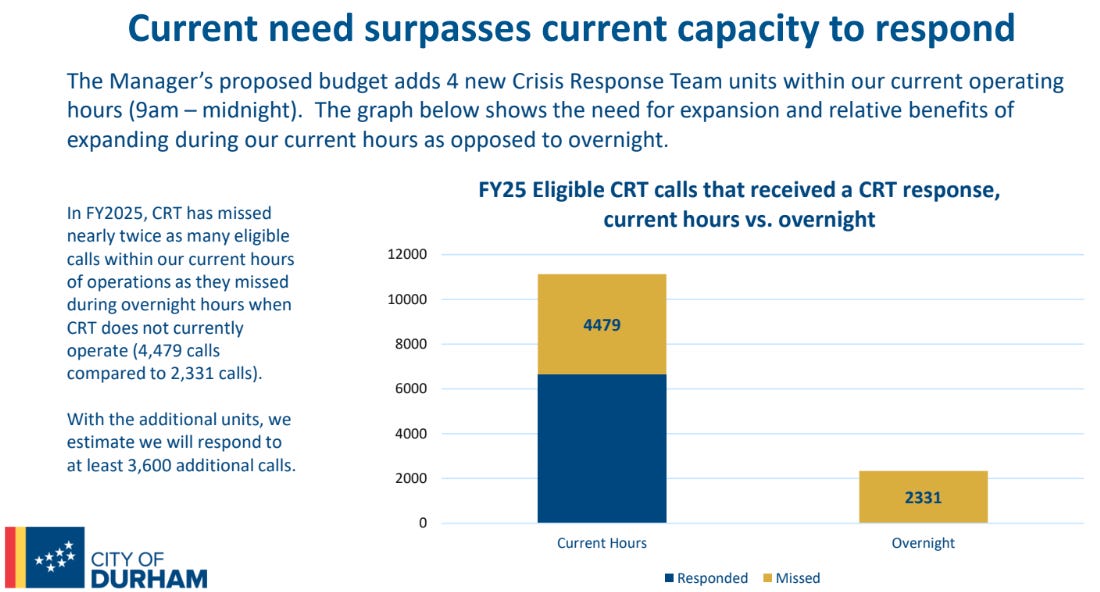

Takeaway #5: HEART is expanding its daytime coverage to best meet the city's unmet needs. In analyzing calls, the Community Safety Department found that more residents would be served by expanding services to daytime calls (see chart below). I'm excited to share that the Community Safety Department will also launch the new Office of Survivor Care to provide critical services to victims of gun violence.

Takeaway #6: Durham's Minimum Livable Wage Ordinance will increase at a rate nearly double the city's largest increase ever seen. Because of the city's MLW Ordinance uses a definition with the average rent of the last four years, city worker minimum wages have not kept pace with rising cost of living; but that is starting to change as economic uncertainty slows the region's housing frenzy and the rapid rise in rents over the past 4 years starts to impact the MLW Ordinance definition. To meet the ordinance two fiscal years from now, minimum wages would rise above $25/hour. This is a critical value statement and one that we need to hold the line on and implement well (avoiding wage compression as much as possible). While North Carolina's minimum wage remains unlivable, the city's wages and benefits place pressure on other major employers to improve their working conditions. Last year's $28 million investment in city worker wage increases has also begun to decrease vacancies. We must ensure we pay our city workers enough to live and thrive in Durham, push to expand labor and tenant unions, and regain control at the state level to increase the shamefully low minimum wage as well as expand leave and health care benefits.

Takeaway #7: Greater contributions from developers and the city's largest and wealthiest tax-exempt landowner would help share costs with residents and small businesses. Make no mistake: we need to fight against rightwing attacks on higher education, including the "Woke Tax" intended to redistribute wealth from higher ed to the billionaires. Nonetheless, residents and small businesses across our city need Duke University to share in the role of democratic governance and offset the local tax burden with everyone else. We also must ensure that new development contributes its fair share to the public good -- something that has not been adequate in the majority of new development. That means construction and dedication of public parks and plazas, transit-oriented urban design, green building, public art, smart growth development and conservation in master planned communities, and meaningful contributions of affordable units.

Takeaway #8: The City is contributing more to clean up contaminated parks. More information is expected from the state this month. This year's CIP includes an additional $7 million for lead remediation on top of last year's $5 million. The state's soil test results are anticipated this month will help inform partial and full remediation costs and timelines and interim options. Relatedly, work has begun using the parks, sidewalks, and streets bond residents approved last year.

Takeaway #9: Both the City and the County general funds are losing millions of dollars of revenue from the occupancy tax. Locally supported state legislation begins removing public dollars from the city and county's general funds this year and diverting those funds into a new nonprofit focused on tourism and advocacy for a new Convention Center, Durham Next.

The city and county must continue to prioritize pressing issues like homelessness and education where funding from municipalities is a key ingredient. Baker says that even the smallest amount of funding adds up, and city leaders will now have to find new sources to maintain their financial commitments to replace the loss of revenues to the city’s general fund.

-IndyWeek article, July 30, 2024

Takeaway #10: Sales tax revenue decreased for the first time in over a decade. Sales tax is the City's second largest source of revenue, behind property tax. For years, sales tax revenue has consistently grown each year. This year, sales tax revenue has come in under projections and below what was collected last year, leading to more conservative projections for the coming fiscal year.

Politics and strategy of the local budget Durham is a manager-strong form of government with a weak mayor who is part of the seven-member Council. The City Manager listens to the priorities put forward by Councilmembers and the staff departmental leadership, as well as Community Conversations and other community input, and makes a determination on how he wants to propose the budget. Once the budget is proposed, Council has the power to make changes, but any changes require the support of four or more Councilmembers and requires further analysis by the Budget and Management Services Department. Based upon my conversations with other Councilmembers, most believe this budget largely reflects the diverse opinions and priorities of the existing Council, with some desired changes. That said, constituent feedback and other Council priorities could still result in some changes between now and the adoption of the budget.